Business Valuation

98% of American business owners don’t know the value of their business. Yet they expect this very same business to fund over 80% of their retirement. Small business owners have a fiduciary responsibility to know what their business is worth. That’s the only way to determine if you’re on track to increase its value, protect it and have the ability to monetize the value in order to retire comfortably.

Know your business value and how to grow it

Crossroads Advisers provide indicative business valuations for the small & mid-market sector.

Take our free Value Gap Assessment and follow up with our accredited advisors to learn about our business valuations, and how they offer so much more than just a valuation figure.

We specialize in working with business from $1 million to $15 million in revenue

Business Valuation

Capitaliz

As an owner, it’s vital that you’re intentional where you choose to invest and spend your time in the business. You have two important questions you need to ask yourself after reviewing all of the information provided in this assessment:

1. How much value do Ineed to create in my business to achieve my goals?

2. How much of that value is from scale, profit and non-financial aspects?

Our Advisors can provide a more detailed Business Insights Report offering a far more accurate breakdown of your business valuation and the key value drivers, as well as an estimate of your value potential and the activities that need to be undertaken to maximize business value and achieve your goals.

Business Valuation

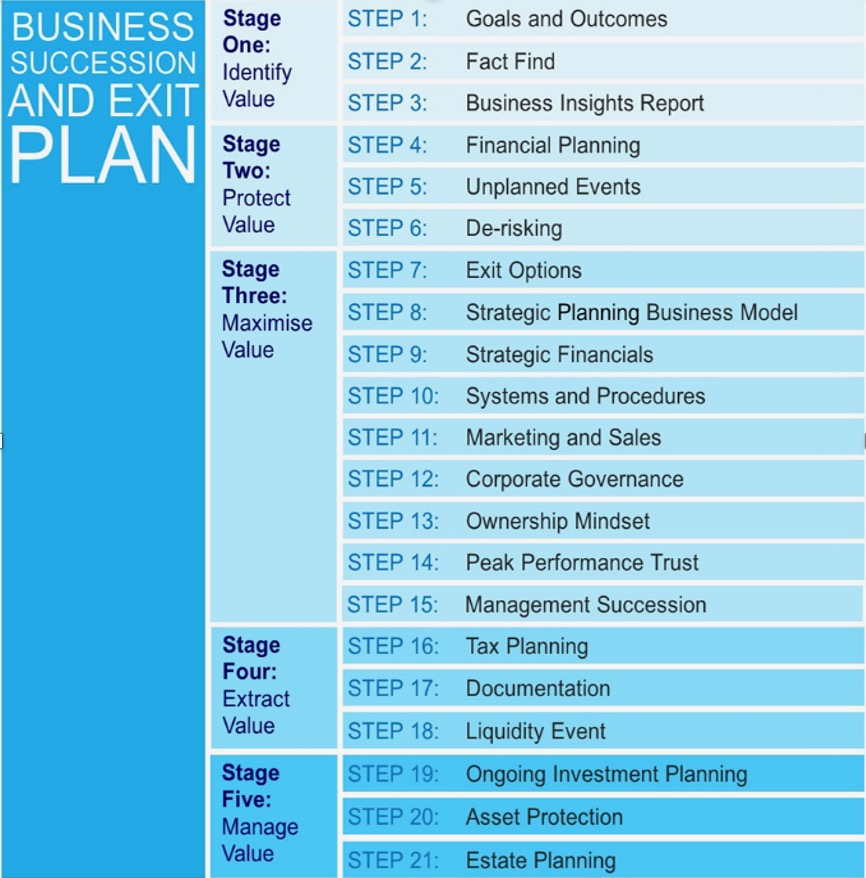

21 Steps

Our 21-step process, divided into five key stages, is designed to guide you through a seamless business exit.

Stage One focuses on identifying the true value of your business. Stage Two is about safeguarding that value. Stage Three is where we maximize it, using strategies to enhance and accelerate growth. In Stage Four, we facilitate the extraction of value through the transaction process. Finally, Stage Five (steps 19 to 21) ensures that post-exit, your assets are protected, your estate is organized, and your retirement funds are securely managed. This structured approach ensures every detail is covered for a smooth transition.

Business Valuation

BizEquity

98% of business owners don’t know the value of their business.

78% of business owners plan to fund retirement through the sale of their business.

60% of business owners haven’t met with a financial advisor.

75% of business owners don’t have a succession plan in place.

40% of business owners have no insurance.

Let us help you to see what your largest asset is worth so you can understand your position in the competitive landscape, make smarter personal and professional financial decisions, and be confident in your projections.

Take it from our Clients!

Christopher brought an immense amount of knowledge and experience helping us with actual sale of the business as well insight from personally transitioning his business. As we met with prospective buyers, he was always extremely helpful and kept the discussions on track.

My business partner and I attempted to transition our privately held business. We realized that while we were regarded as experts in our field of business, we did not have the skill set, nor the experience in the field business transition.

Christopher’s experience, professionalism and transition methodology ensured the process remained on track, addressed our needs and concerns, educated us and made adjustments as the process moved forward.

We greatly appreciated Christopher’s expertise and would recommend Crossroads Advisers to others when considering a transition for their business.

We contacted Christopher at Crossroads Advisers to sell our business. He was able to sell my business for a fair price with in an acceptable time frame and provided help and resources. In addition to the wealth of knowledge and experience Christopher brought to the table, he genially is a very nice person.