Business Transition Planning

Crossroads Advisers understands the unique requirements of each transition method and works with each business owner to develop a transition strategy in order to address your business and personal transition goals.

Our business transition methods offer business owners the proper steps and planning needed to ensure a successful outcome. Our business transition methods involve similar and unique planning requirements based on who may be receiving or purchasing the ownership of the company.

We specialize in working with business from $1 million to $15 million of value

Business Transition Planning

Succession

A business succession plan is a written plan intended to guide the business owner with a step-by-step procedure that clearly outlines the transition of the business upon retirement, death or disability. The succession process is a significant life event for the business owner that entails a comprehensive approach in order to meet the goals and desires of the business owners More detailed information.

Crossroads Advisers understand that most business owners will only go through the business transition process once. And, most business owners will rely on the proceed from this process to fund most of their financial retirement needs. It is critical to have the succession plan done correctly to satisfy both their personal and business goals. Crossroads Advisers 5-Step Program increases the success of a business owners business succession plan.

Our plan will outline such issues related to:

- Identifying & Preparing your successor

- Identifying and implementing ways to increase the value of your business

- Establishing and implementing a succession timeline

- Outlining and executing your personal and business readiness concerns

- Working with and coordinating your succession plan with your other advisory team

- Working and developing your life after business plans in line with your life styles

Business Transition Planning

Exit Planning

Crossroads Advisers will design an Exit Plan that is unique to each business owners’ goals, desires and timeline that can maximize the value of your business.

By engaging in this process early, business owners will increase their odds of a successful outcome through initiating a plan that will increase the value of their company. When designing your plan Crossroads Advisers work with you to:

- Increase the business value

- Address business attractiveness & readiness concerns

- Assess personal well being & wealth planning matters

- Address life after business items

- Work with you to design your business transition team

Proper Planning = Successful Exit

Planning is Everything!

Only 1 out of every 5 business are transferable, that equates to an 80% failure rate. Our goal is to change this paradigm by working directly with business owners to develop Transition Plans for Succession/Exiting of their business.

Business Transition Planning

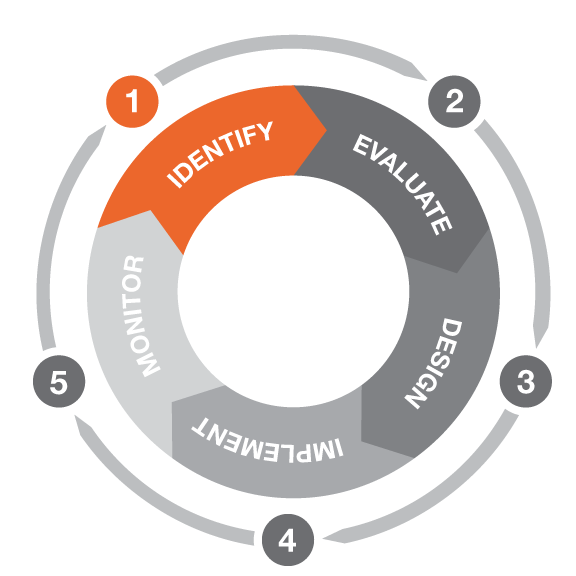

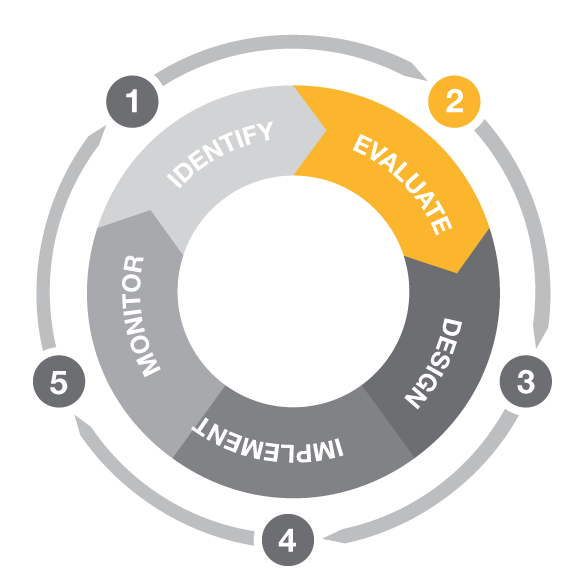

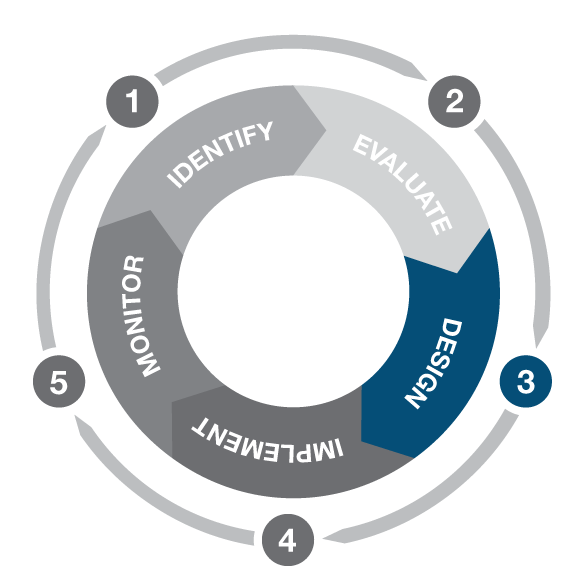

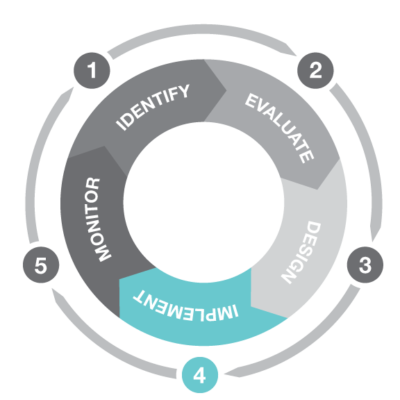

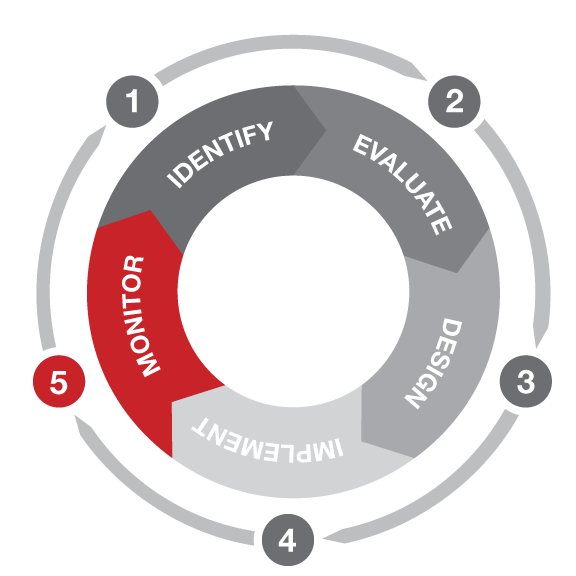

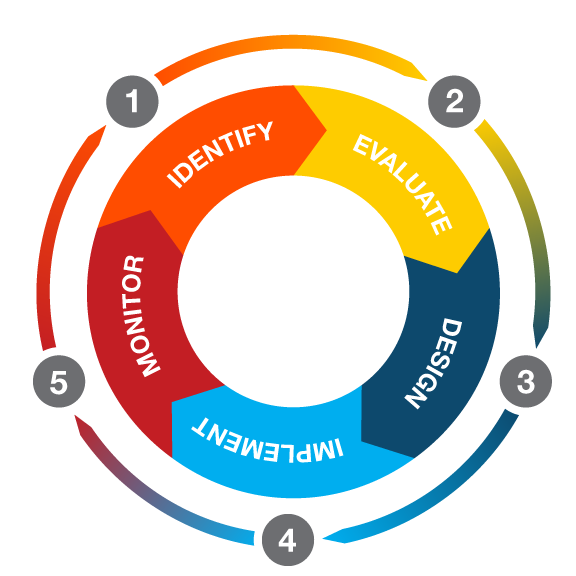

Our 5-Step Plan

Crossroads Advisers 5-Step Business Transition Planning Process is specifically designed customized to ensure that both your business and personal goals are achieved and aligned with each other. Crossroads Advisers designed our Step Business Transition Planning Process to be adaptable to both the Succession Planning or Exit planning process. Additionally, our 5-Step Business Transition will adapt to short range and long-range business transition timelines.

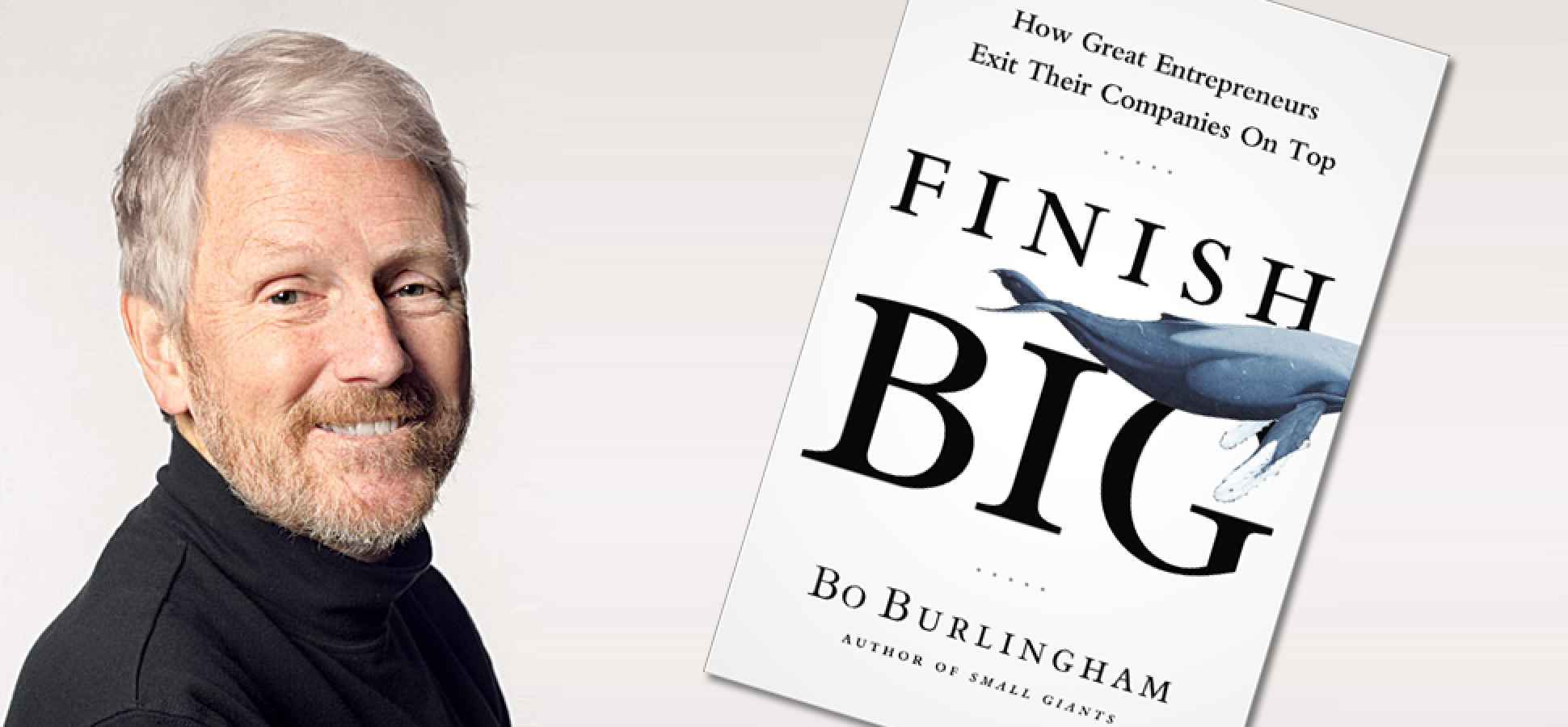

Endorsed by Bo Burlingham Author of Finish Big

Our 5-Step Business Transition Process has been endorsed by Bo Burlingham the Author of Finish Big, How Business Entrepreneur’s exit Their Company on Top”